Cash Flow & Cash Reserves

JoAnna Ahn

A practice’s net cash flow is essentially the amount of cash coming into the practice less the amount of cash coming out. A practice’s ability to maintain a positive net cash flow is important for several reasons: 1.) positive cash flow is an indicator of profitability, 2.) it reflects the practice’s ability to pay off their expenses, and 3.) it allows for planning for future projects.

The ability to generate a steady cash flow gives the practice flexibility in operating the practice and allow a greater focus on patient care. A key objective here is to demonstrate that routine activity in operating a practice should be monitoring cash flow and the components of a practice that influences the generation of cash.

The primary objective of this case study is to understand how the income statement and balance sheet can impact cash reserves and methods that can be used to improve cash flow.

Scope of Challenge

Net cash flow comprises of the difference between cash in and cash out of the practice. The cash coming in includes deposits made for hearing aid purchases and other payments received from patients (collected accounts receivable). Cash outflows would consist of payments of bills (accounts payable, loan payments, paid taxes, or an Owner’s distribution).

When a practice is presented with a situation where cash is not enough to pay for an immediate need, the owner needs to understand how they are able to respond quickly. While increasing sales and reducing operating expenses can have

Case Description

This case study involves a practice that records income and expenses on an accrual basis. Income and expenses are reported predominantly on an accrual accounting basis. (Accrual accounting is a financial accounting method that allows a company to recognize revenue and expenses in the time-period when they are incurred, and in the case of revenue, that can mean before receiving the cash payment for goods or services sold. Owners can choose an accrual or cash basis of accounting when managing financials. The choice of which system to use is typically determined between the practice owner / business manager and the practice’s Certified Public Accountant (CPA). Basically, an accrual basis of accounting records income and expenses when the service occurs (invoice is sent) whereas in a cash basis of accounting income and expenses are recorded when funds are received/disbursed.

This case study involves a practice that records income and expenses on an accrual basis. Income and expenses are reported predominantly on an accrual accounting basis. (Accrual accounting is a financial accounting method that allows a company to recognize revenue and expenses in the time-period when they are incurred, and in the case of revenue, that can mean before receiving the cash payment for goods or services sold. Owners can choose an accrual or cash basis of accounting when managing financials. The choice of which system to use is typically determined between the practice owner / business manager and the practice’s Certified Public Accountant (CPA). Basically, an accrual basis of accounting records income and expenses when the service occurs (invoice is sent) whereas in a cash basis of accounting income and expenses are recorded when funds are received/disbursed.

Practice A is owned by a husband and wife in which the wife is one of two full-time audiologists. The practice also employs three administrative staff members. Net revenue through June is $246,000. The owners’ cash balance has been steadily declining over the past few reporting periods and they are facing a large amount of payments due in the form of accounts payable and credit card balances. Unless the practice can improve their cash position, they will have significant problems in meeting their financial obligations, one of which is paying off a large loan amount.

After reviewing their financial statements, the owners were presented with several action items that could help increase cash flow in the short term as well as improve cash flow management in the long term.

Methods and Results

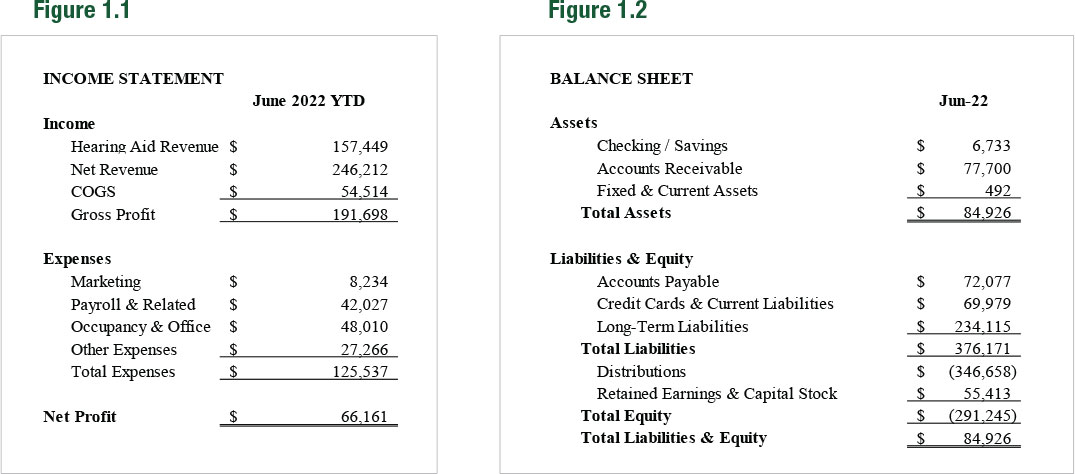

Monthly financials are shown in Figure 1.1 (income statement) and Figure 1.2 (balance sheet). The income statement in Figure 1.1 shows that for June year-to-date (YTD), which covers a six-month time frame, the practice has generated net profit of $66,161 with net revenue of $246,212, or 26.9% of net revenue. Based on YTD amounts, the practice has maintained their profitability. Total expenses ($125,537) are 51.0% of net revenue. The average monthly payroll expense is $7,004 per month ($42,027/6).

The balance sheet in Figure 1.2 shows the amount of cash available to the practice owners at the end of June is $6,733. This balance is a concern because this amount of cash cannot cover the average monthly payroll expense of $7k which was determined from Figure 1.1. Note that the balance sheet also reflects credit card balances and current liabilities totaling almost $70k. (Current liabilities are debts that are due within a short timeframe, typically within one year or less). Cash will be required to pay these liabilities as well as the accounts payable amount of $72,077. Another potential issue is if the cash position cannot improve, the long-term liabilities ($234k) on the balance sheet won’t be paid down in the future. The owners have assessed their situation with their financial consultant and understand the need to address the immediate need for cash as well as the need for a plan to increase their cash reserves.

Discussion

The financial consultant was able to recommend a few actions that could help the owners meet their immediate cash needs and direct them on a path to build up their cash reserves over time.

Income Statement

The largest driver of cash flow on the income statement is revenue and the ability to generate more of it. In the short term, staff can make a conscious effort to ensure provider schedules are full so that the practice has every opportunity to generate added revenue. The practice needs to consider methods to drive patients (new or existing) into the practice or effectively convert appointments into hearing aid and service revenue. This may require additional marketing spend or a review of operational efficiencies (effectiveness of front office staff and/or providers).

The income statement also provides information on spending trends. An immediate impact on cash can be seen if there is a pause on discretionary spending until the cash reserves improve. Reducing spending arbitrarily across the board may not be helpful as any spending related to employees (payroll or insurance) or practice growth (marketing) would only be a short-term solution and may not benefit the practice in the long term. For example, decreasing payroll by cutting staff or working hours would affect workflow, staff morale and potentially limit the number of patients being seen for care.

Balance Sheet

The owners were able to note the large accounts receivable balance of $77,700. If they can focus on collections of past due or late amounts, this would have an immediate impact to their cash balance.

The owners focused on scheduling time for staff to make follow up calls to patients and insurance companies for payments. To hold staff accountable for making the calls, an accounts receivable (A/R) report and tracking sheet were updated weekly and reviewed by owners. An ‘aging report’ would group accounts receivable in terms of how long the amounts are past due. Accounts are considered past due when payment has not been received within the timeframe agreed upon between the practice and patient (credit terms). Collections calls could be scheduled based on the aging of accounts: those who have the longest aging would be first on the list to call. Note that, for many businesses (in and out of the hearing care space), the longer the age of outstanding balances, the less the chance of collecting the amount at a later date. It is important to avoid customer accounts from becoming too ‘old’ by continuously monitoring the accounts receivable balance. The risk of late payments could also be mitigated with a policy of late fee charges.

The practice could also attempt to delay the timing of the cash outflows to temporarily hold more cash on the balance sheet. While being consistently late in payments to vendors/manufacturers is not recommended, the practice could ask their vendors for longer credit terms or the possibility of making partial payments on their accounts.

Management

It was also strongly recommended that a weekly cash call/review be done to understand how cash is flowing into and out of the practice. Preparing a weekly forecast of cash receipts and disbursements would highlight where the practice would need to focus their efforts as well as help to anticipate cash needs.

Considerations

What takeaways can be made from this case study? The situation presented in this case could be found not only in any audiology clinic, but also in any business regardless of industry.

- While managing the income statement and balance sheet is not the primary role of an owner/practitioner, as a business owner there should be a basic understanding of profitability and financial health. This becomes especially important if the owner/practitioner decides to transition into more of an owner/manager role or if an exit strategy becomes part of the owner’s goals.

- Cash flow and cash reserves are important to the practice as they allow for expenses to be paid, provide reassurance that unexpected needs can be met in case of a shutdown (e.g., due to pandemic or weather-related disaster) or a drop in sales (due to an economic downturn or seasonality). Healthy cash flow also allows for projects/plans to be funded, which in turn allows the practice to grow. Positive cash flow and a comfortable cash reserve adds value to the practice, which positions the practice positively to potential buyers or creditors.

- Everyone within the practice can have some impact on cash flow. While providers are responsible for the actual treatment of patients which result in hearing aids being sold, other staff members contribute to making sure the opportunities are available for the providers. Staff members also make sure that payments are being made by patients and insurance companies. Owners contribute to improved cash in that they can monitor accounts and focus efforts on those with balances trending in the wrong direction.

Questions to the Reader:

Questions to the Reader:

- Would a small business loan or line of credit be a goodoption to cover a short-term cash problem?

- What level of cash reserves is “enough”?

- If the practice was holding inventory on the balance sheet, how could that impact cash?

- Would a smaller practice approach cash flow differently from a larger, more established practice?

- How could the practice owner involve staff/employees in improving cash flow without sharing sensitive financial information?

Discussion of Questions:

1. Would a small business loan or line of credit be a good option to cover a short-term cash problem?

It depends. Credit is not a bad thing as it helps the practice use their cash on hand more efficiently towards operating activities. However, the practice needs to consider their current debt load and their ability to make the payments. While a loan or credit line would allow for an influx of cash, servicing the debt would impact cash flow when payments begin. Depending on their financials, the practice may not qualify for additional credit or funding from an outside source. Alternatively, a source may be willing to extend a loan or credit, but because of the financials, the interest rate does not make this option financial sense due to the payments being too high. In the case of this case study, credit/loans should be considered only after all other avenues of generating cash have been attempted and there is an immediate need.

2. What level of cash reserves is “enough”?

Similar to a family budget, the ratio of cash reserves to average monthly expenses is a good metric to determine how much cash to have on hand. A good level of cash would be equivalent to at least three months of operating expenses, more if the owners prefer to be more conservative, if they anticipate any issues coming up, or if they would prefer to self-fund a large purchase or project.

3. If the practice was holding inventory on the balance sheet, how could that impact cash?

A balance of hearing aid inventory reflects hearing aids which have most likely been ordered as part of a bulk purchase (to take advantage of some discount or promotion from the manufacturer), or hearing aids ordered for a patient who has not been fitted yet. This inventory may have already been paid for, which would mean no further cash outflow would be required, or the manufacturer’s invoice has not been paid yet and some dollar value is included in accounts payable, which will require additional cash outflow when payment is due.

The opportunity for increasing cash reserves comes with setting appointments for patients who simply need to be fitted for the hearing aids ordered for them or bringing in patients who could potentially benefit from the hearing aids that are being held in stock. Once the patient has completed the treatment, the hearing aid in inventory “becomes cash” from an accounting standpoint.

4. Would a smaller, new practice approach cash flow differently from a larger, more established practice?

A larger practice would hopefully already have a few processes in place to monitor cash. The assumption is that the owners would have a better understanding of how their business performs and can anticipate their cash needs. The focus on cash flow and maintaining their cash reserve allows the established practice to fund projects or capital expenditures to continue to grow. A smaller, new practice should be focused on building an initial cash reserve, preferably to cover three months (or more) of operating expenses. The smaller practice owner should also be establishing operating procedures to collect accounts receivable, handle vendor payments, effectively schedule appointments, etc.

5. How could the practice owner involve staff/providers/employees in improving cash flow without sharing sensitive financial information?

Some roles within a practice may need access to portions of financial statements to perform their functions. An example would be a front office staff member making collections calls would need to have accounts receivable balances to plan their call schedule. A person in charge of paying bills would need access to accounts payable to understand timing of payments. Providers are aware of hearing aid pricing (revenue) as they are prescribing treatment for patients. While everyone has some information about elements that influence cash, only the owner (or their trusted representative) would be able to take the data to analyze cash. The owner, rather than provide full financial transparency, can create targets related to the different roles, which if met, contribute to the improvement of cash flow. An example could be those tasked with managing collections would need to ensure receivables balances are no higher than a certain dollar or doesn’t increase more than a certain percentage month after month. Another metric could be the number of hearing aid units needed to cover costs of goods sold and operating expenses. An additional number of units can be added to this breakeven analysis to establish a unit target for providers. ■

References

- Financial Accounting, Warren, Carl S. and Fess, Philip E., South-Western Publishing Co., Cincinnati, OH, 1994. JoAnna Ahn is the marketing director for Audigy.

JoAnna Ahn is the marketing director for Audigy.